EOSedge

Alphatec Holdings (ATEC) has terminated the tender offer agreement (TOA), dated 26 February 2020, under which it was to acquire EOS imaging for up to US$88 million in a combination of cash and equity.

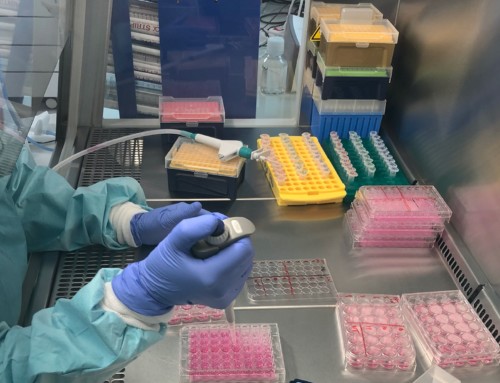

EOS imaging is a specialist in orthopaedic medical imaging and software solutions. The EOS technology informs the entire surgical process by capturing a calibrated, full-body image in a standing (weight-bearing) position, enabling precise measurement of anatomical angles and dimensions.

The decision follows ATEC’s consideration and analysis of the expected ongoing market effects of the COVID-19 pandemic. Based upon its assessment, ATEC concluded that a “material adverse effect”—as defined in the TOA—has occurred, resulting in circumstances that are no longer conducive to completion of the transaction. ATEC notified EOS of its termination decision, as required by the TOA, in a letter dated 24 April.

In connection with the termination of the TOA, ATEC and Perceptive Credit Holdings III, LP, have agreed to terminate the commitment letter for up to US$160 million in secured debt financing, which was intended to retire ATEC’s existing credit facilities and fund the cash required to complete the acquisition of EOS.

“We continue to believe that there is tremendous strategic value in an ongoing relationship between ATEC and EOS, which could enable growth acceleration for both companies,” said Sam Chawla, portfolio manager, Perceptive Advisors. “Our confidence in ATEC and its management team remains strong, and we look forward to future opportunities to provide our support.”