Source: BIBA MedTech Insights TAVI Tracker

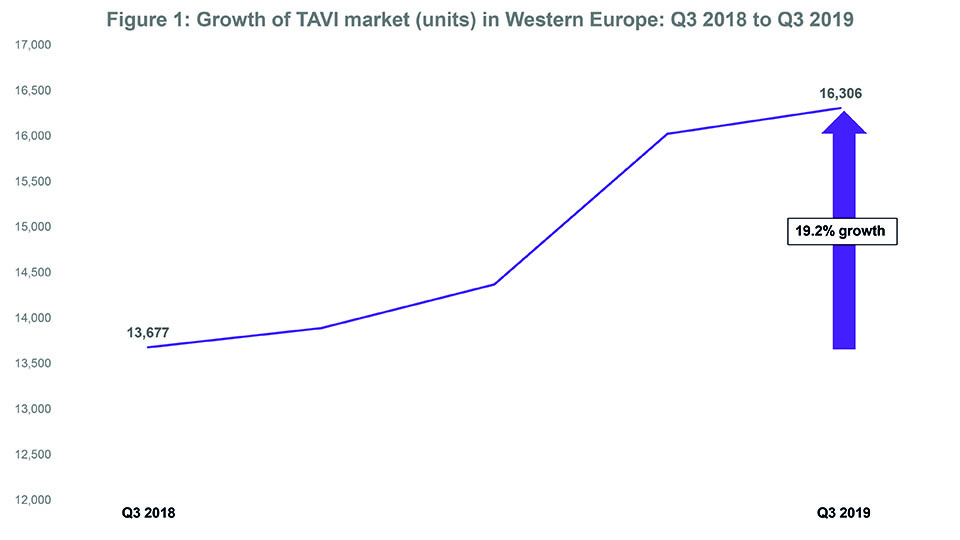

- The TAVI market in Western Europe grew by 19.2% between Q3 2018 and Q3 2019.

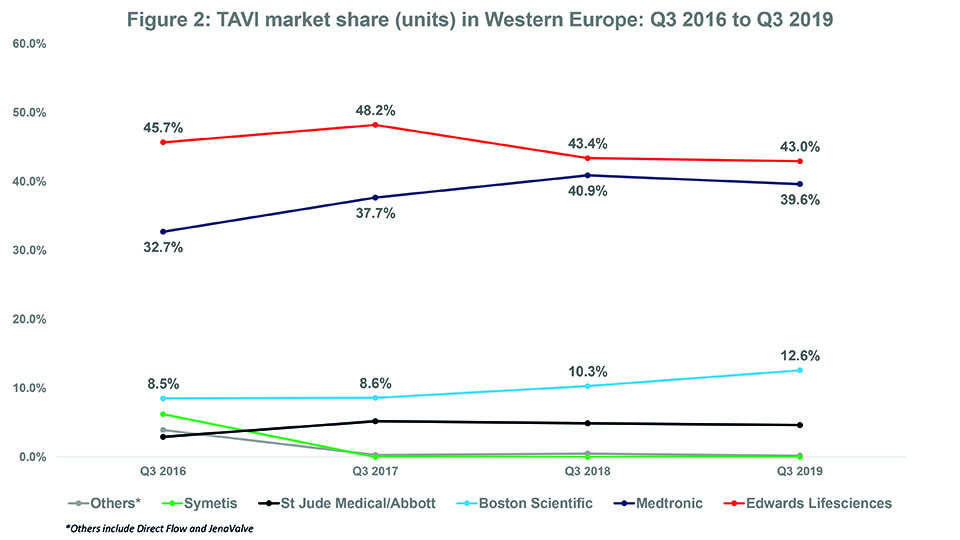

- Over the last three years, Edwards Lifesciences (the market leader) lost market share while Medtronic and Boston Scientific both gained market share.

- Boston Scientific’s acquisition of Symetis in Q2 2017 helped the company maintain its third place position in the Western European TAVI market.

Source: BIBA MedTech Insights TAVI Tracker

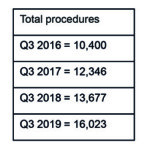

Data from BIBA MedTech Insights (TAVI Market Tracker) show that the transcatheter aortic valve implantation (TAVI) market in Western Europe is continuing to grow. In Q3 2019, 16,306 devices were implanted—representing a 19.2% growth since Q3 2018 (see Figure 1). Furthermore, Edwards Lifesciences and Medtronic continue to be the top two “main players” with Edwards Lifesciences remaining as the market leader. That said, the gap (in terms of market share) between Edwards Lifesciences and Medtronic appears to be closing.

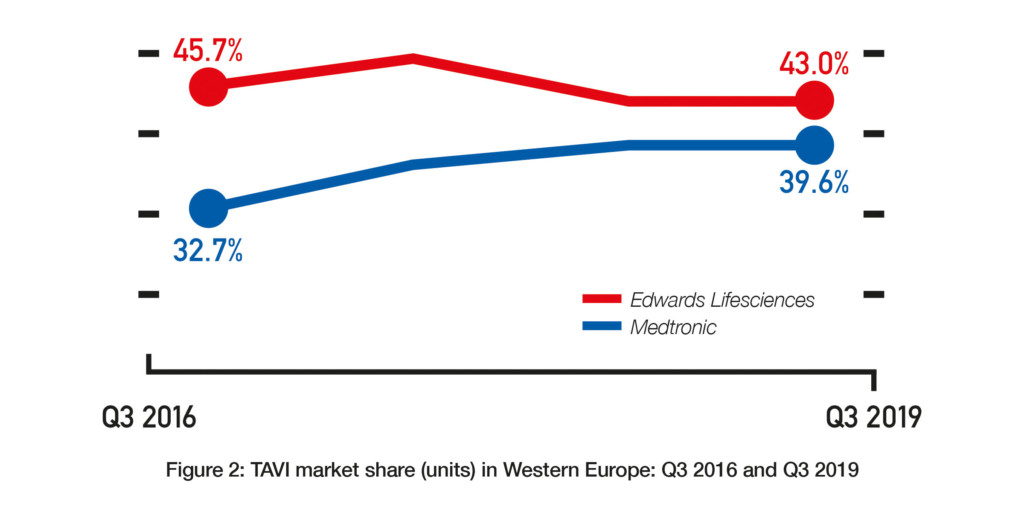

In Q3 2016, Edwards Lifesciences had a market share of 45.7% while Medtronic had a market share of 32.7%. Since then, Edwards Lifesciences’ market share has tended to decrease while Medtronic’s market share has tended to increase. In Q3 2019, their respective market shares were 43% and 39.6%. See Figure 2. Whether this trend for Edwards Lifesciences to cede market share to Medtronic (and other companies) will continue is unknown. There are a couple of reasons as to why Edwards Lifesciences may actually see an increase in market share in future. First, as of November 2019, it is the only company to have a TAVI device (Sapien 3) that is CE-mark approved for low-risk patients.1 The CE mark indication is likely to lead to an increase in the number of low-risk patients undergoing TAVI and, we could assume, by extension to more Sapien 3 devices being implanted. However, Medtronic may at some point receive the CE mark for its CoreValve device to be used in low-risk patients. The FDA approved its Evolut R and Evolut PRO devices, along with Edwards’ Sapien 3 and Sapien 3 Ultra, for low-risk patients in August 2019.2 Therefore, one would expect Medtronic to receive a similar European indication.

Source: BIBA MedTech Insights TAVI Tracker

Another reason why Edwards Lifesciences’ market share may increase, at least in comparison to Medtronic, is that two recent studies have indicated that the Sapien range has a mortality benefit over the CoreValve range.3 Though a caveat to this finding is that the studies were not randomised head-to-head comparisons and included older generations of the devices. Furthermore, Mohamed Abdel-Wahab (Department of Internal Medicine/Cardiology, Heart Center Leipzig, University of Leipzig, Leipzig, Germany) told BIBA Briefings that although both Sapien and CoreValve can probably perform in a similar way in “a large percentage of patients”, balloon-expandable valves (i.e Sapien) may be better for some patients while self-expanding valves (i.e. CoreValve) may be better for others. Thus while these studies by themselves should not lead to Sapien being seen as a superior device, they may be used as a prompt for future research—such as direct head-to-head comparisons or trials reviewing whether patient characteristics (such as anatomy) should be a factor in choice of device.

Boston Scientific

Source: BIBA MedTech Insights TAVI Tracker

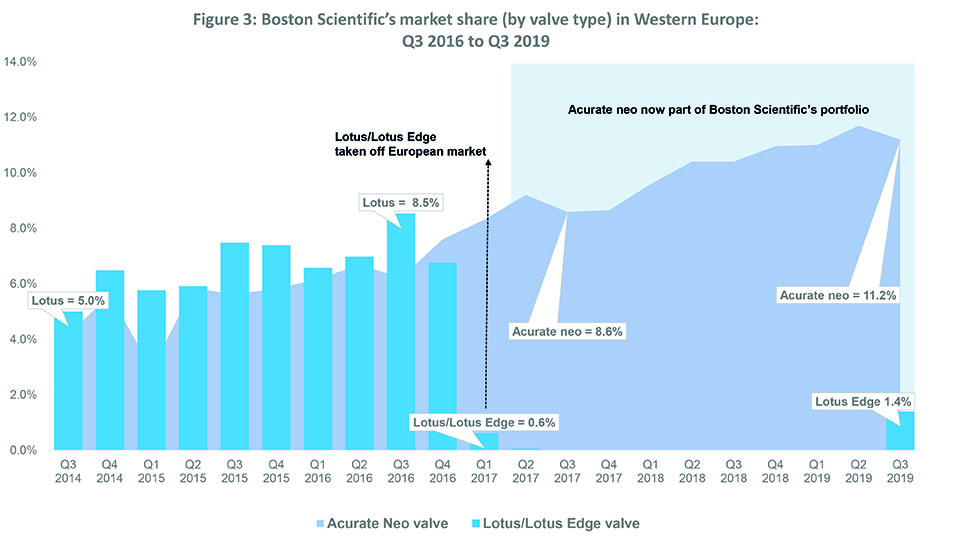

Like Medtronic, Boston Scientific has seen an overall increase in market share over the last three years—from 8.5% in Q3 2016 to 12.6% in Q3 2019—while (mostly) sustaining its position as “third player” in the TAVI market (see Figure 2). This is predominantly down to its acquisition of Symetis (and thus, the Acurate neo valve) in Q2 2017.4 In Q1 2017, the company withdrew its Lotus/Lotus Edge valves from the European market because of an issue with the delivery system.5 Boston Scientific’s market share dropped to 0.6% immediately after the recall. However, after completing its acquisition of Symetis (the fourth player in Q4 2016), Boston Scientific saw its market share increase to 8.6% by Q3 2017 (all Boston Scientific valves implanted that quarter were Acurate neo); it also consolidated its position as third player. See Figure 3.

In Q1 2019, via a controlled launch, Lotus came back onto the Europe market (and Lotus Edge received FDA approval in Q2 2019).6 BIBA MedTech Insights data show that 226 Lotus devices were implanted in Western Europe Q3 2019, accounting for 11% of Boston Scientific TAVI devices implanted (2,052 overall).

Possible challenge from Abbott

At present, Abbott is the fourth player in the TAVI market having bought St Jude Medical (and its Portico device) in Q1 2017.7 There is some potential for it to overtake Boston Scientific as the third player. SCOPE 1, which was presented at the 2019 Transcatheter Cardiovascular Therapeutics (TCT) meeting, found that the Acurate neo device did not meet the criteria for non-inferiority to Sapien 3.8 So, potentially, this could lead some operators to stop using the device and Boston Scientific’s market share to decrease. As a result, Abbott may surpass Boston Scientific in the Western European TAVI market. Of note, PORTICO 1 (also presented at TCT 2019) found Portico to be non-inferior in terms of safety and efficacy to FDA-approved devices (including Sapien 3).9 However, there are too many variables to accurately predict the effect of SCOPE 1 on Boston Scientific’s market position. Even if the trial did lead to fewer Acurate neo devices being implanted, Lotus implants could go up—ensuring Boston Scientific sustains it market position.

Both Abbott and Boston Scientific are working on next-generation versions of their devices, with both focusing on reducing the rate of paravalvular leak with their existing devices.8,9 At the Piper Jaffray 31st Annual Healthcare Conference (3–5 December, New York, USA), Susie Lisa (vice president, Investor Relations at Boston Scientific) said that Boston Scientific does expect to see growth for Acurate neo to “slow a bit” but added that the company was excited about launching the next-generation version in Europe this year (mid 2020).10 Lisa explained that the next-generation device had a skirt to “help address paravalvular leak”. She also reported that Boston Scientific saw Acurate neo as “a really good valve”, commenting: “we have gone back to all of our key implanters who feel, frankly, that their clinical experience is not reflected in the SCOPE 1 results”. “They know it is a very good valve and have no intention of changing their implant pattern. So that is why we talked about expecting to see Acurate growing at kind of that mid-teens rate. Admittedly, I think new account openings will be tougher. So that is what we said, that is an expected slowdown that should be addressed with the launch of Acurate neo-2,” Lisa explained.

Hello to MyVal; goodbye to Centera

In Q2 2019, Meril received the CE mark for its MyVal device. 11 BIBA MedTech Insights will only start to track this in Q1 2020, but its TAVI Tracker did find that 32 devices implanted in Q3 2019 came under the category of “other”—so that could include MyVal devices.

Last year also saw Edwards Lifesciences pull its self-expanding device Centera from the market (Q3 2019). The device, which had been on the European market for just over a year, only accounted for 1.5% of all Edwards devices implanted in Q2 2019. Therefore, its withdrawal is unlikely to negatively affect Edwards’ market share.

References

- Edwards Lifesciences. Edwards Sapien 3 TAVI receives expanded approval in Europe. Date accessed: 13 January 2020.

- Cardiovascular News. FDA approves Sapien 3 Ultra, Sapien 3, and CoreValve for low-risk TAVI. Date accessed: 13 January 2020.

- BIBA Briefings. Two studies suggest mortality lower with Sapien than with CoreValve. Date accessed: 13 January 2020.

- Boston Scientific. Boston Scientific closes Symetis acquisition. Date accessed: 13 January 2020.

- Cardiovascular News. Locking mechanism problems prompt Boston Scientific to recall all ranges of its Louts TAVI device. Date accessed: 13 January 2020.

- Cardiovascular News. Lotus Edge becomes third TAVI device on US market. Date accessed: 13 January 2020.

- Abbott completes the acquisition of St Jude Medical. Date accessed: 13 January 2020.

- Cardiovascular News. Acurate neo does not meet non-inferiority compared to Sapien 3.

- Cardiovascular News. Safety and efficacy of Portico valve noninferior to FDA-approved TAVI systems Date accessed: 13 January 2020.

- Seeking Alpha. Boston Scientific Corporation (BSX) Management presents at Piper Jaffray 31st Annual Healthcare Conference (Transcript). Date accessed: 13 January 2020.

- Cardiovascular News. Meril unveils positive data for Myval Date accessed: 13 January 2020

- Cardiovascular News. Edwards Lifesciences drops Centera in favour of focusing on Sapien range. Date accessed: 13 January 2020.